How would it feel to be completely debt free?

I hear many forms of “I’ll always be in debt, so why bother?”

But it doesn’t have to be this way.

Like any new habit, whether it is exercising or losing weight, the best approach is the one that works for you! I will give you the framework in this post, but you can tailor your plan in a way that you will act on.

There are many methods for paying off debt, but they all have the same basic framework. The goal of this post is to help you understand the basic framework, and decide on your first step to take in paying off your debt.

Why Become Debt Free?

1 - It’s probably causing you stress

Debt has become an increasing part of Americans’ lives, yet it adds so much stress when thinking about finances. With over half of U.S. adults always or often feeling stressed about their debt, it’s having a negative and often silent impact on so many lives

Whatever the source of your debt, you can pay it off. It’s easy to get in the mindset of “it’s just a monthly payment”, but have you considered the total cost of that car with the auto loan interest or fast food meal on a credit card?

2 - You will have more financial freedom

The great thing about paying off debt is that it frees up your money so you can put it where you want to or need to.

Paying off debt reduces stress about finances. I think we are so used to debt being a part of our lives and our culture that it doesn’t seem possible to pay it off.

While taking on debt may have been unavoidable at some point in life, I do think there is a spiritual element to the stress and anxiety it can cause.

Prayerfully considering how to get out of debt and how to view your money and possessions going forward is part of your journey with God.

3 - Being Debt Free Allows you to be more financially generous

If you already have a lot of debt, the thought of one more “expense” is overwhelming. However, when we begin to view our money as being stewards of it instead of owners of it, our perspective changes.

For a long time, I had no interest in giving more than the bare minimum. It was really my husband who felt called to give more and he appealed to me to get on the same page.

While I haven’t felt this earth shattering sense of doing good, I know logically that it does. The bigger lesson I have personally learned through it is that God really will provide for me, especially in the rough seasons.

A word of encouragement

As with starting any new habit or pursuing any new goal, it can be hard. Paying off debt may be simple, but it also requires a new money mindset and new habits.

How to Create Your Debt Payoff Plan

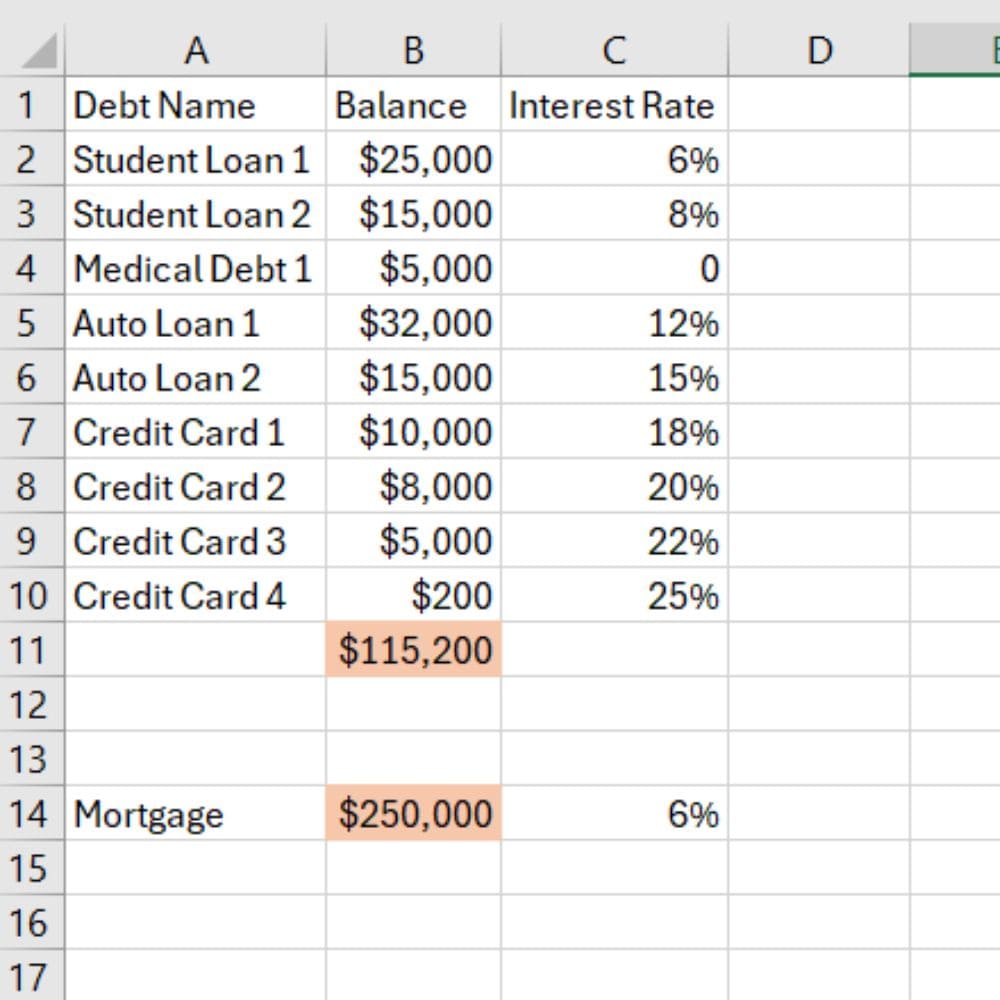

List Out Your Debts

Open a worksheet, and create 3 columns.

Name your columns:

Debt Name

Amount Owed

Interest Rate

Go through all of your debts and put them into a worksheet. The goal is to get all of your debts in one place so you know the total amount of debt you have and the breakdown of those debts.

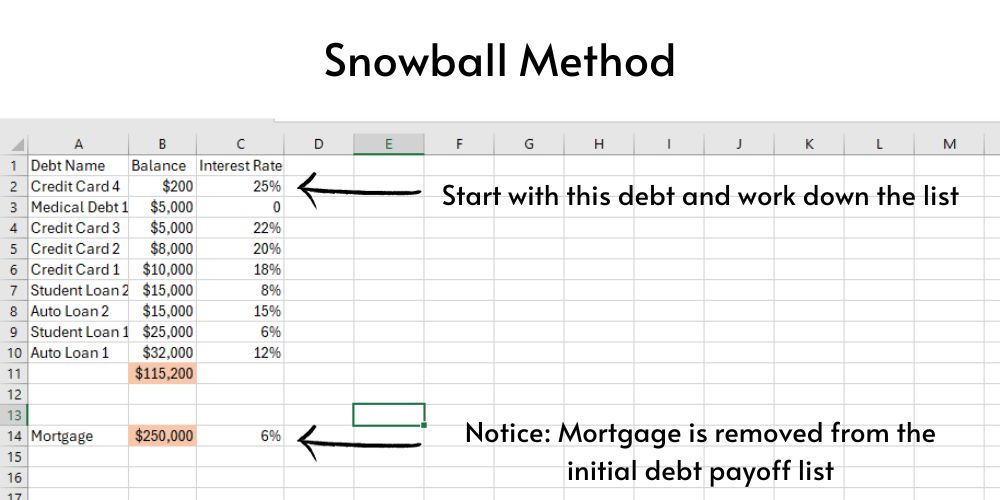

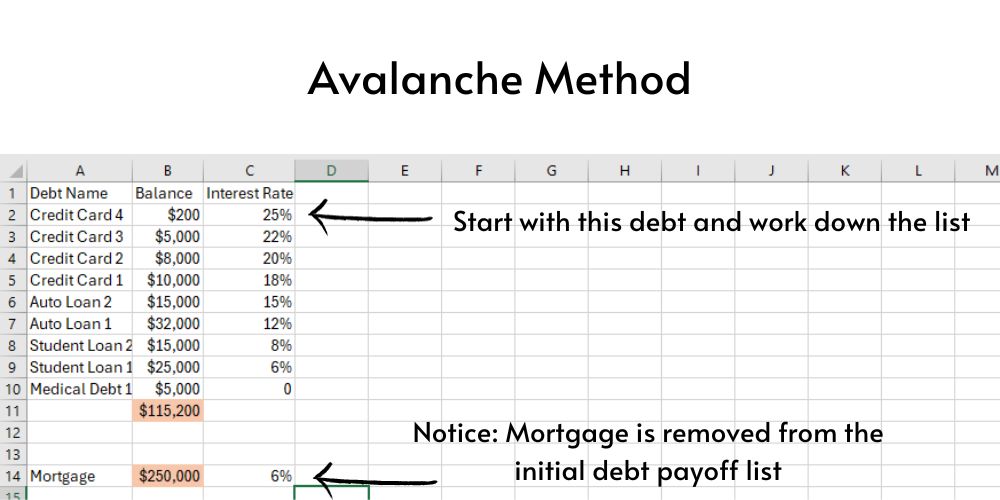

Focus on paying off all consumer debt first. As mortgages tend to be the biggest debt with the lowest interest rate, it is best to save that for last, no matter which debt payoff method you choose.

Create a Budget

Create a budget with debt payoff in mind. This post walks you through how to create a budget that will work for you.

The Goal: Understand your current income and expenses so that you can determine how much extra Money you can put toward your debt monthly.

Debt Payoff Methods

The two most popular methods are the Snowball method and the Avalanche method.

The Snowball method:

Order your debts from the lowest balance to the highest. Put all your extra money into paying off each debt in this order.

The avalanche Method

Order your debts from highest interest rate to lowest. Put all your extra money into paying off each debt in this order.

The only other option I can think of is paying off a debt that you feel especially bad about. I have heard of people who feel embarrassed or ashamed every time they look at a particular credit card bill, for example. In this case, I think it’s totally okay to focus on paying this debt off first.

Decide Where to Start

No matter what method you choose, it’s going to be of the most benefit to you to stick with it.

Once you have all of your information in one worksheet, decide (with your spouse if you’re married) which debt to pay off first.

Once you’re looking at all your debts, it may be tempting to look at how much you will save by paying off one debt as opposed to another. Don’t get too into the weeds with it, the important part is to decide what to do and have a written plan. Then, take action

Create Your Plan

Depending on your interest in personal finance, the more or less complicated your plan will be. If this is new territory for you, keep it as simple as possible. It is easy to get frustrated and give up if you create a plan that is overly complicated or a tight timeline. You can always make adjustments to your plan after a few months.

No matter what you want to include, here is a basic framework for your plan to pay off debt

After You have created your budget, it’s time to DECIDE How to put it into action:

- Which debt will you pay off first?

- How much extra money will you put toward paying off your first debt?

- What is your time frame to pay off your first debt?

- When are you going to make your first payment toward that debt? The sooner the better!

- When your first debt is paid off, find a little way to celebrate!

I hope this has helped you in deciding to pay off debt and creating a way to do so!

What made you decide which debt to pay off first? Snowball Method? Avalanche Method? A debt you can’t stand seeing any longer?