This is probably about the millionth post about creating a budget on the internet. My goal is to help you create a budget that works for YOU! And that will change and evolve as YOUR finances change and evolve!

While the mere word “budget” may be intimidating, creating one to live by is so freeing! We will be breaking down how to create a budget you can stick to no matter the financial season you’re in.

What is a budget?

Simply put, a budget is a plan for your money. Starting with your income, you can then plan expenses, debts, and savings goals.

Often, when we look at our bank account we wonder where our last paycheck went. With a budget, the goal is to stop wondering where the money went, and instead tell it where to go.

There are many different methods for budgeting. Today, we are just going to use a simple spreadsheet to track expenditures, debts, and savings goals. This is a great way to start to get a current idea of where your money is going.

Once you know how you have been handling money and decide how to allocate your spending, feel free to choose a different budget method that will help you stay on track.

Budgets can range from accounting for every dollar to developing categories and assigning a percentage of your income to that particular category.

Developing an overall picture of how you have been operating with money and how you would like to operate with money in the future will help give you a framework for your budget.

Why Should I Have a Budget?

A budget is a plan for your money. You are telling it where to go, and making adjustments as needed.

The best time to start a budget is now. There’s no need to put it off until the next month…or the next year.

Since it’s so easy to live on debt and shape your life around it, the temptation is strong to just give in to what you want, or feel you should have. Creating a budget can keep these temptations in check.

Figuring out where all of your income and borrowed money is going can be intimidating but it’s a helpful practice.

With how easy it is to charge a credit card for living expenses, it’s really important to know what your living expenses are. Knowing these facts helps you to figure out how to decrease borrowed money in any way.

Knowing how much debt you currently hold, what your spending habits are, and knowing what your income is will give you the tools to create your first budget.

While it may not be necessary to track every dollar for every month for the rest of your life, it is important to start off budgeting by combing through every purchase. A good place to start is to look back on your last 3-6 months of expenditures to get a realistic picture of where your money is going.

If you do not stay within budget for the first month or two, give yourself some grace. Budgeting does take some getting used to, especially if you’ve never done it before.

However, it’s helpful to realize that to be successful in budgeting, two characteristics are almost as important as the actual numbers: planning and discipline.

Planning

You need to plan for balancing your life with school, work, hangouts, kids, etc so why not apply that same practice to your finances?

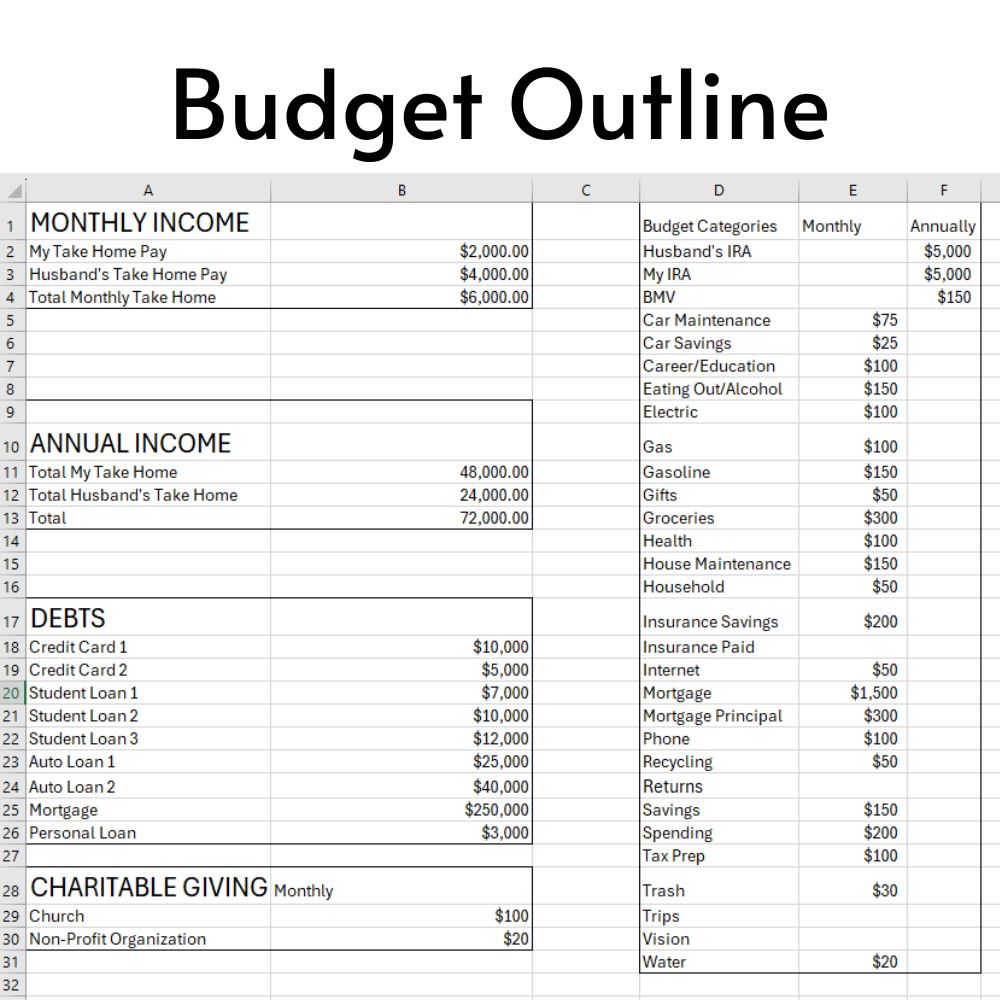

Knowing all sources of your income, all sources of your debt, and all sources of your spending will give you the figures you need to create a budget. Once you have this information, then you decide where your money needs to go every month.

Once you get the hang of budgeting your current expenses, take some time to look at your long-term goals, dreams, and realities. Maybe you want to pay off your credit card by age 30 or maybe you want to take a dream vacation to Europe. Whatever it may be, having a plan for money now can help you achieve these things in the future.

Discipline

While a budget is creating a plan for your money, discipline is acting on that plan.

This is the painful part of budgeting. Some may find creating a budget fun, especially with so many apps and worksheets. However, discipline to carry out the plan is difficult. Discipline is going to encourage you to say “no” to some (not ALL) fun or comfortable stuff.

It will be so worth it in 1 week, 1 month, 1 year.

Discipline in carrying out your budget can help you develop this skill in other areas of your life like school work, work ethic, or managing time more effectively.

While this may seem daunting, I urge you to keep at it. I’m going to walk you through how to create a budget, and I want you to decide on the actionable steps you are going to take to stick with it!

How Do I Make a Budget?

First, let’s talk about what you’ll need to make your first SIMPLE budget. While there are many options for apps and worksheets, I think that using an Excel/Google sheet gives you more control and helps you to think through where every dollar is going.

I think manually reviewing your expenses helps you be more aware of your spending habits. If you know what your spending tendencies are, you can then learn how to address them.

Once you are used to budgeting and aware of your weak points, you may find it beneficial to switch to an app to help automate your budgeting.

In addition to your Excel sheet, gather your previous 3-6 months of expenditures and all of your current debts.

You can download your transaction activity in a CSV format on just about any credit card or bank account.

If you primarily use cash, save every receipt for the next month and use that information to develop a budget.

Don’t forget about money spent through PayPal/Venmo and quarterly or annual expenses.

GOAL= Know how much you are Spending vs. Making while accounting for Savings, Giving, and Debt

Like many new tasks, starting a budget can be pretty demoralizing. I encourage you to pray over your budget. If you are married, it is vital to do this process with your spouse. It can be a very unifying thing.

Take Time for a Moment of Gratitude

This might sound odd, but before sitting down to create your budget, write down 3 things you are grateful for.

For me, looking at my finances can highlight what I DON’T have. I have found that practicing intentional gratitude helps keep a more balanced view of what’s in my bank account.

This helps fight against the frustration or fear that can come from looking at your finances.

Here are some prompts to help you think about what to be grateful for!

Formula for a budget

Review Your Current Spending Patterns

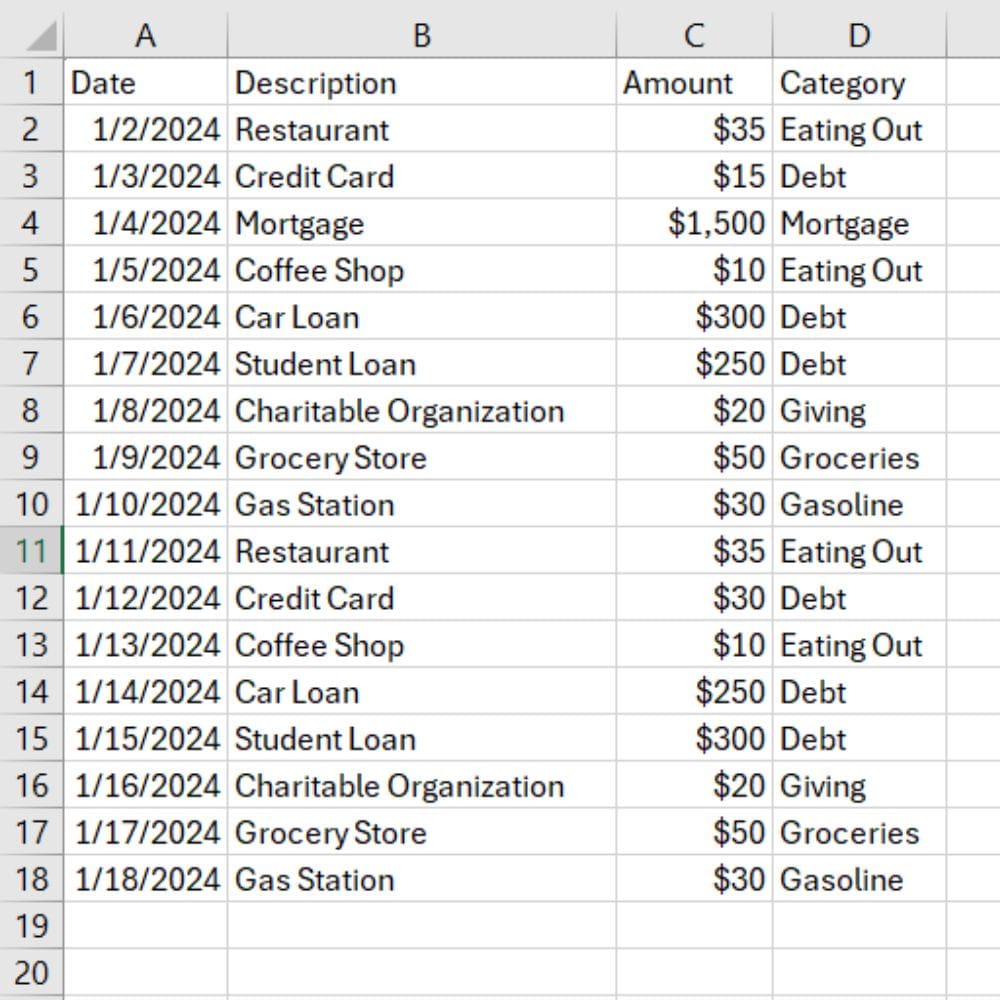

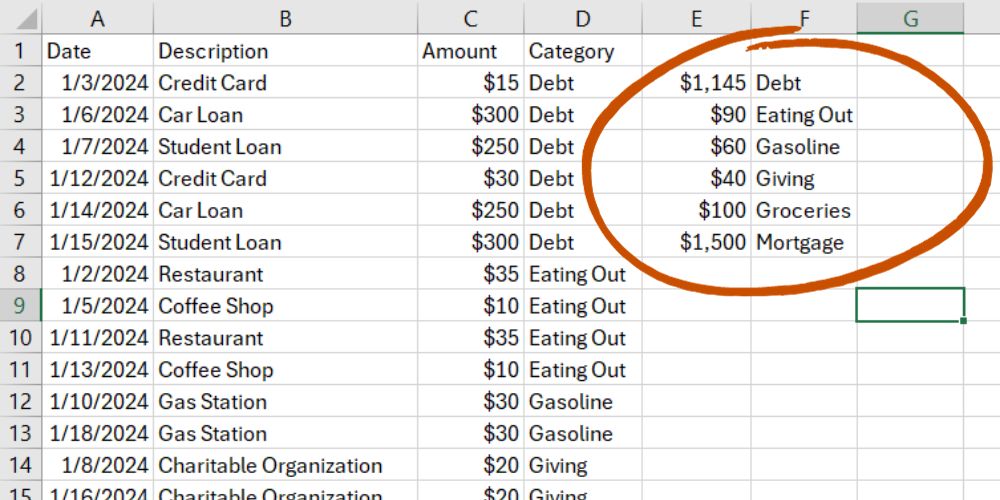

- Get your last 3-6 months of bank statements together

- Note down the major categories for expenses

- Categorize all of your expenses from the past 3 months.

- Categorize your expenditures.

- List the totals for each category. Keep the categories general to start.

Determine Your Budget Going Forward

Determine what was a necessity and what was not.

A necessity is something you need to live.

While a Chipotle burrito is a food (which you need to live), it does not make it a necessity

After looking at what is a necessity and what is not, give a dollar amount to each category, based on what is a necessity.

Along with this, consider what expenses need to be cut.

For example, maybe you buy a bottle of water every day at the vending machine. Instead, you decide to invest in a water bottle and refill it throughout the day. Even though the initial investment will be higher, you’ll get your money’s worth very quickly.

Set up your spreadsheet in whatever way makes the most sense to you.

The goal of this process if for you to understand what you have been spending your money on and what needs to change.

Debts

Create a list of all the debts you owe on your spreadsheet. This serves as a reality check. After all, without a plan for paying back debt, achieving some of your goals and dreams may be more difficult, if not impossible.

Paying off consumer debt – credit cards, student loans, car loans, personal loans, etc – should be your priority. It probably looks daunting looking at your debts listed all in one place. There are generally two ways of paying off debt:

1- Snowball Method – This was developed by personal finance guru Dave Ramsey and involves ordering all of your debts in order from lowest dollar amount to highest dollar amount and paying off in that order.

2 – Avalanche Method – ordering your debts from highest interest rate to lowest interest rate and paying off in that order.

I don’t think either one is better than the other. The best one for you is the one that motivates you to pay down your debt. If you need a quick win, the snowball method is probably better for you. If you cringe every time you see money going to a high interest loan, than the avalanche method is probably better for you.

Another note – You may feel guilt or shame about a particular debt you have. If you hate seeing that debt, it may be worth it to bump that one to the top of the payoff list.

Evaluate your expenditures every month

This will probably only take an hour but it gives so much valuable information to know the totals you are spending on each category. You will probably need to make adjustments as you follow your budget.

While living on less than you make is a rigid rule if you want to experience financial freedom, your budget can be flexible from month to month.

Things to Consider While Finalizing Your Budget

Savings Goal

This will pick up steam after paying off your consumer debt. Most personal finance professionals suggest an Emergency savings account of 3-6 months of living expenses. I generally think this is a pretty good goal. Consider how much you can contribute toward an emergency fund, even if it’s as little as $5.00 a month!

After figuring out the amount you need in your emergency fund, determine what else you want or need to save for. Around this topic, I think it’s motivating to consider what your long-term goals are (one parent stay home with the kids? Travel? Home renovations?)

I think it’s always helpful to keep dreams and goals in life at the forefront of my budgeting because it gives the budget a purpose. It gives you something really exciting to work toward.

Buffer

Budgeting can get demoralizing pretty quickly if you can’t stick to it immediately. There are still many months when I spend more than I would like, so I totally understand!

Creating a buffer, especially at the beginning of your budgeting journey will help you give you confidence, as well as have some money set aside for unexpected or forgotten expenses

Charitable Giving

While most personal finance experts say you should pay off all consumer debt BEFORE other expenses, I personally think charitable giving is an exception. It might feel intimidating even thinking about giving one of your hard earned dollars when you have so many debts and financial obligations.

As Christians, we are called to be generous. I’ve heard many people say “be generous with your time” or other resources.

However, I think there is something unique that happens when we choose to give financially. We are invested in the church or organization that we are supporting.

Many verses throughout the Bible speak to the benefits of giving:

Proverbs 22:9 – The generous will themselves be blessed, for they share their food with the poor.

Psalms 112:9 – They have freely scattered their gifts to the poor, their righteousness endures forever; their horn will be lifted high in honor.

Acts 20:35 – n everything I did, I showed you that by this kind of hard work we must help the weak, remembering the words the Lord Jesus himself said: ‘It is more blessed to give than to receive.’ ”

Additionally, giving money when we receive nothing in return changes our perspective on our entire financial situation.

If you are in the debt payoff phase, I encourage you to start giving $1 a month. If you are done paying off debt, prayerfully consider how you might increase your charitable giving.

I hope you are feeling encouraged and empowered to start a budget and a debt free journey! If you have any thoughts or questions, drop them in the comments!