Do your finances feel like a mess? It’s a common feeling and can be tempting to give up hope that you will ever get ahead.

While it’s difficult to face your finances if they feel like a mess, it is necessary to get them organized in order to set financial goals and ultimately get ahead with your money.

Even if your finances are not in a perfect place in a day, the goal of organizing your finances is to be aware of your money. This includes knowing where it’s coming from and where it’s going.

It’s important to take this information and create a budget. But first, get familiar with your overall current financial picture.

Here is a 5 step Guide to Organize Your Money

1 - Know your debts

I have a step-by-step guide on how to organize your debts and create a debt payoff plan, so I won’t go into depth here. For the sake of organizing your expenses, it’s good to just know what debts you have and where they all are.

Debts to track

You may have all, none, or some of these types of debts. For now, just track them in a spreadsheet. Keep track of the amounts and interest rates for each one.

Debts you may have:

- Medical debt

- Student loans (list each out individually if applicable)

- Auto loans

- Credit cards

- Personal loans/misc debts

- Mortgage

Next, make a plan for how to pay them off.

This will go hand in hand with your budget, which I’ll get to later on.

2 - Know your bills

Maybe you’ve had a surprise bill. Or a subscription you forgot about. Whatever your bills are and whenever they’re due, it’s helpful to have this information all in one place.

Go through all credit card and checking account transactions

Yes, this will take time. However, it will help you be aware of where your money is coming and going.

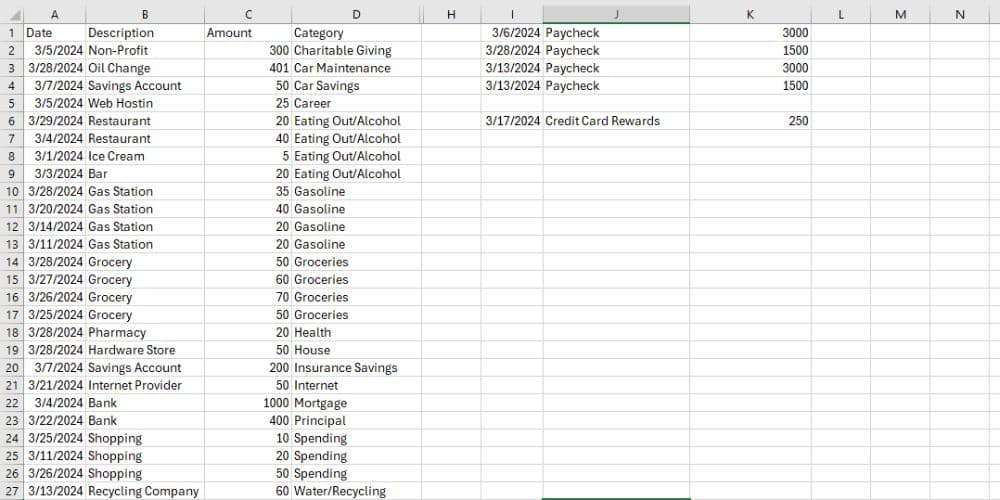

I download all my credit card and checking account transactions each month and sort through all of the expenditures. While this may not always be necessary for you, it is a good way to become very familiar with your bills and spending habits.

Is there anything you forgot as you reviewed CC transactions?

If you pay for some things on different credit cards, and some things from your bank account, it can be easy to lose track of all automated payments.

Here’s what that looks like:

Cash Transactions

If you don’t already, keep track of your receipts and how much cash you withdraw. I don’t use cash too often anymore, but when I do, I track my purchases in a note on my phone.

When I used predominantly cash, I tracked how much I withdrew each month and kept my receipts to review my expenditures each week.

3 - Know your income

Do you know how much hits your bank account?

While you probably know your overall salary, it’s good to know how much is withheld for taxes, 401(k), HSA, etc. It’s easy to set these things up and then forget about them.

Extra income

In my monthly expenditures report, I keep track of any extra income we receive. This is from a variety of sources including:

- Credit Card rewards

- Gifts

- Side hustle money

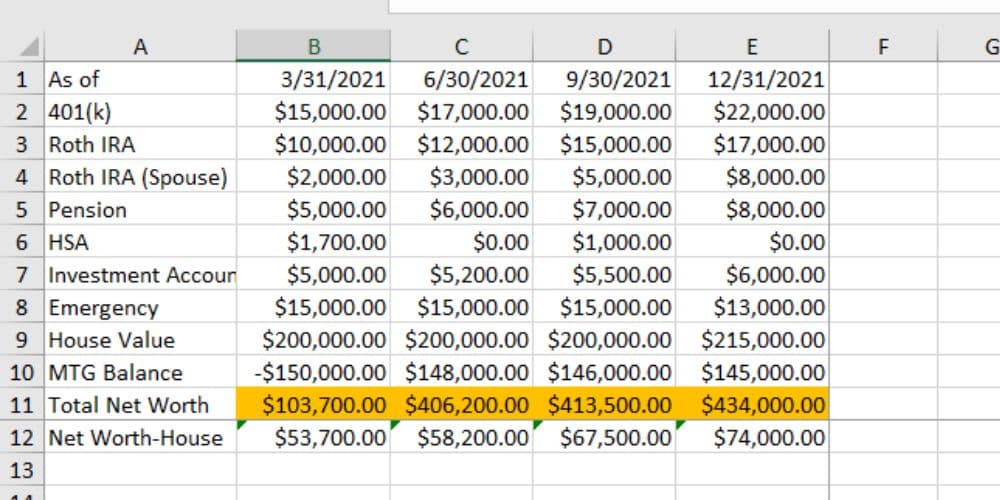

Tracking net worth

Net worth is essentially what you own MINUS what you owe.

I track our net worth in a tab that’s in the same file as our annual budget. In this tab, I have all of the applicable accounts in one column, then I check the balances quarterly.

What do you need to track your net worth?

Your situation may include additional assets, but this is a good place to start:

- Savings acct balance

- Investment accounts balances

- Retirement accounts balances

- House value

- Balances on all debts

Subtract all of your debts from the total of your assets.

A Note about Net Worth

It can be really easy to worry about this amount and maybe feel like you are behind for your age or generally wish the number was greater.

I’ve felt this way, but had to remember that there have been setbacks as well as gifts and I try to be grateful for that. Each event has been a financial lesson.

A Biblical Perspective

While I do think it’s important to keep track of finances and helpful to track net worth, it can also be tempting to be consumed by it. I struggle with this.

First Timothy offers us wisdom on how to view money in this life:

1 Timothy 6:10 – For the love of money is the root of all kinds of evil. And some people, craving money, have wandered from the true faith and pierced themselves with many sorrows.

1 Timothy 6:17-19 – Teach those who are rich in this world not to be proud and not to trust in their money, which is so unreliable. Their trust should be in God, who richly gives us all we need for our enjoyment. 18 Tell them to use their money to do good. They should be rich in good works and generous to those in need, always being ready to share with others. 19 By doing this they will be storing up their treasure as a good foundation for the future so that they may experience true life.

4 - Summarize all of this in a budget

The culmination of organizing your money is a budget.

A budget is a collection of all the pieces of your financial picture. This is taking all of your debts, income, and expenses into account and how to manage them.

I have one tab for my annual budget and one tab for my net worth. This gives me the ability to see my overall financial plan at a glance. It has taken me several years to hone in on what I need to have in each piece.

It is worth it to organize your money and have all your information together. This makes visualizing goals and dreams so much easier.

You may find another method you prefer for keeping track of your finances – there are many apps and software programs. However, I encourage you to start with a spreadsheet because it helps you to comb through every financial item.

Budgeting can takes time and effort to make a habit, but it is worth it to get your finances together and be familiar with where your money is going.

Tracking Expenses

This is looking back on the month and seeing what I spent versus what I budgeted for. If you are new to budgeting and in a tight financial situation, you may want to do this weekly.

As I mentioned previously, I download all my credit card transactions and sort through and categorize them. This helps me see where we are in our budget for the month.

Because I am so familiar with my spending patterns now, I don’t feel the need to check things weekly, but it took me a long time to feel that way.

Synthesizing all the information into a budget will also clarify for you where you want to spend money.

Putting money where you value will mean cutting back on money elsewhere.

5 - Figure out where to cut costs

As you are putting together a budget and a debt payoff plan, you will probably find it helpful or necessary to cut costs.

It’s easiest to start with the most obvious…extra subscriptions, grocery shopping at Aldi (or other discount stores), cut back on eating out.

I have put together a list of ways I like to cut down on everyday expenses. These are ways you can save money that you may not have considered before.

There is No One Size Fits All

Everyone’s financial situation is different. However, that doesn’t mean you should give up on tracking finances because they can get messy.

I naturally love tracking my finances and probably take too much security from money. I used to track everything down to the penny and watch our accounts almost weekly.

Realizing I was stressed and anxious from doing this, I decided to take a step back and reduce the effort I put into tracking expenses and accounts.

My husband and I are on the same page with our budget and very well aware of our expenses and spending patterns so this has not been an issue.

However, if you struggle with keeping your finances organized or spending when it’s not in your budget, it’s totally okay to have to keep a closer eye on things – at least for a season.

What is your biggest hurdle to organizing your finances?